SWAMSN Capital AG – your IPO Boutique.

We offer tailored advisory services focused on Reverse-IPOs.

Our services include all types of capital market measures, Equity Research, Investor Relations and especially designing and executing Post-IPO activities with specialized market makers and brokers.

Going public via IPO, RE-IPO or SPAC

A matter of the right tactic.

Going Public via IPO

Going Public via RE-IPO

Going Public via SPAC

In this scenario, the company goes public with the help of a SPAC (Special Purpose Acquisition Company). A SPAC is a vehicle that is already listed on the stock exchange and has already raised capital from investors through an IPO with the aim of investing it into the acquisition of an operating company.

Going Public via IPO, Re-IPO or SPAC

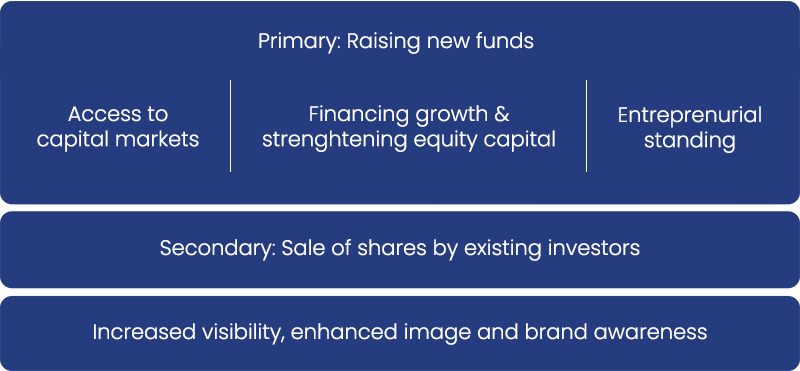

The stock market listing is carried out by an Initial Public Offering (IPO), in which the company offers its own shares for sale with the aim of having them admitted to a desired stock exchange for trading. In this scenario existing shareholders are mainly looking for raising new funds, sale of shares, increased visibility, enhanced image and brand awareness.

Re-IPO – our preferred approach.

A Re-IPO brings many advantages, reduces risks and complexity compared to a classical IPO or SPAC.

It is faster, less complex and a safe path to get a company listed, as a place on a stock exchange is already reserved.

Benefits of the Re-IPO Model

No prospectus requirement, no roadshow and no minimum deal size.

Management keeps responsibility, existing investors become majority shareholders.

Why SWAMSN Capital AG?

SWAMSN is your highly specialized IPO partner.

Our unique asset structure, specific capital markets expertise, decades of professional experience as entrepreneurs, paired with our established global network of strategic partnerships, enable SWAMSN Capital AG to continuously deliver outstanding results for shareholders and investors.

ASSETS

Paid-in share capital and no obligations.

SERVICES

Support with the development of a convincing Equity Story and Investor Relations Communication Strategy.

PROCESS

Assistance in development of a Going Public Roadmap including individual Milestones.

Steering and management of assigned market makers and broker houses for a 12 month period after going public.

About SWAMSN Capital AG

SWAMSN Capital AG is a IPO Boutique, specialized in executing listings across European and North American Stock Markets.

We offer tailored advisory services focused on Reverse-IPOs. Our services include all types of capital market measures, Equity Research, Investor Relations and especially designing and executing Post-IPO activities with specialized market makers and brokers.

Our assets and specific expertise, combined with decades of professional experience as entrepreneurs and C-level executives as well as our global network of strategic partnerships are the fundament on which SWAMSN Capital AG is built upon. Our main objective is to leverage existing potentials, create synergies and thereby achieve joint, sustainable success for our clients and partners.

In specific cases, we share the entrepreneurial risk of the company and actively invest into promising businesses and stay actively involved even in the phase after carrying out the IPO.

Stock Exchanges where we are already active.